European Bank for Reconstruction and Development (EBRD)

The European Bank for Reconstruction and Development (EBRD) is a multilateral development bank that aims to promote transition in Central and Eastern Europe, Central Asia and the Southern and Eastern Mediterranean. It provides loans, equity investments and guarantees as well as business advisory services. The Bank is accountable to its shareholders, which include countries from both the region and the rest of the world, plus the European Union and the European Investment Bank. The EBRD is not an IATI member but started publishing to IATI in May 2015.

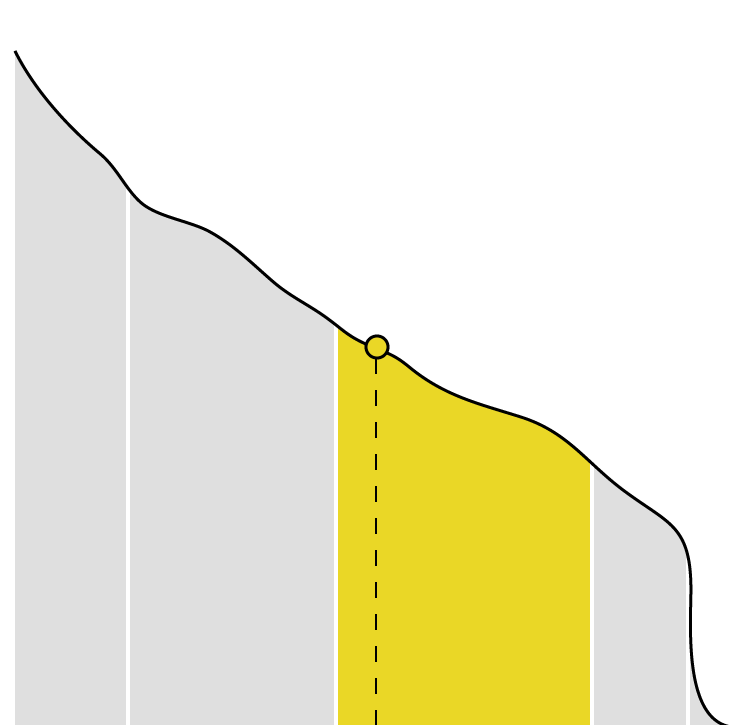

The EBRD remains in the ‘fair’ category. It has increased its frequency of publication, now publishing on at least a monthly basis, up from quarterly in 2016.

It has improved the comprehensiveness of its publication, adding allocation policy, total and project budgets as well as objectives to the IATI Registry.

The EBRD scores full points for all organisational planning documents but country strategies which are only sometimes published in other formats.

The finance and budgets component, however, is still the one in which EBRD achieves its lowest rank, for example, not providing disaggregated budgets and capital spend information.

The EBRD performs well on the project attributes component, barring sub-national locations, which are available only sometimes. The EBRD also failed on some basic elements of its data such as titles, which include many acronyms that make it difficult for external people to understand.

The EBRD performs well on basic joining-up development data, namely aid type, finance type, flow type and tied aid status. While no information about conditions is provided, contracts are sometimes made available. Although not published in an open and comparable format, tenders are always provided in other formats.

There is also room for improvement in the provision of performance-related information. The EBRD only scores for objectives as other indicators, such as results, are not consistently available.

- The EBRD should make improvements to the publication of its financial and budgetary data to include disaggregated budgets and capital spend information.

- It should consistently share contractual information as well as provide subnational data.

- The EBRD should make sure that basic elements such as titles of projects can be understood by non-experts.

- It should make further improvements with regards to the provision of performance-related information.

- The EBRD should consider further extending its transparency efforts to all private sector operations and share best practice with other DFIs.

- To demonstrate the impact of transparency on development work, the EBRD should take responsibility to promote the use of the data they publish: internally, to promote coordination and effectiveness; and externally, to explore online and in-person feedback loops, including at country-level.