Women’s Economic Empowerment:

building evidence for better investments

Definitions

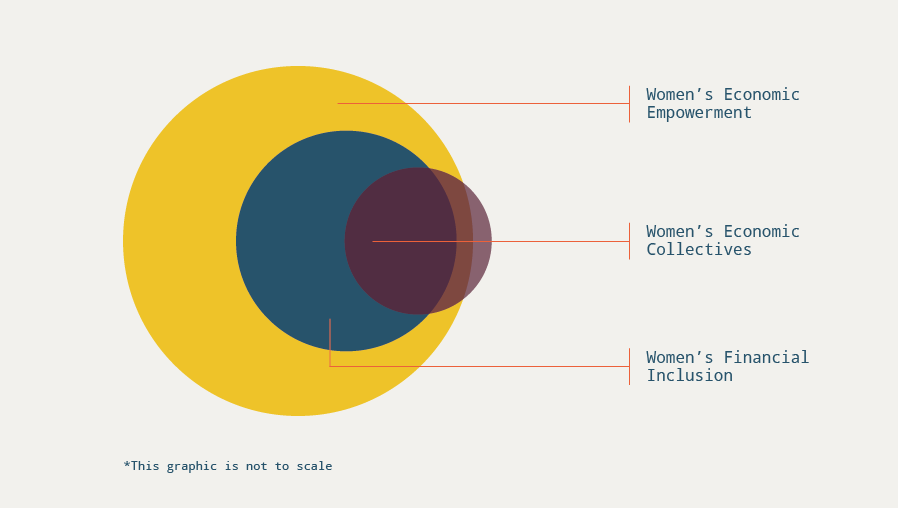

We see women’s economic empowerment (WEE) as central to realising women’s rights and gender equality. WEE encompasses a broad range of processes and outcomes to empower women, ranging from equal access to opportunities within markets to addressing discriminatory gender norms. As a component of WEE, women’s financial inclusion (WFI) is critical to ensuring meaningful access to, usage of, and control over financial services that create economic and social benefits for women. Our project also focused on women’s empowerment collectives (WECs) which have been identified as key mechanisms for accelerating WEE. These groups help build women’s human, financial and/or social capital through programming and training. The focus of WECs can be economic empowerment but also political or social empowerment.

During the inception phase of this project, we conducted a literature review of previous efforts to track funding to gender equality and WEE, and conducted consultations with various stakeholders which informed the intersectional feminist approach outlined in the definitions below.

WOMEN’S ECONOMIC EMPOWERMENT

WEE is central to realising women’s rights and gender equality. It is both a process and outcome of enhancing women’s skills, agency, access to and control over resources, and bargaining power. These qualities enable women to contribute to economic activity and have the necessary resources to support their livelihoods.

When women are economically empowered, they benefit from equal access to and opportunities within markets and are not constrained by structural factors within and outside of market activity, which prevent gender-equitable economic outcomes. WEE is therefore an outcome but also a process of creating enabling environments from the household to the institutional level, including ensuring equitable social provisioning of resources outside of market activity.

WEE entails a rights-based approach, which recognises and addresses the impact of discriminatory laws and gender norms, the disparities in the distribution of unpaid care work with the household, and within gendered labour markets. We advocate that WEE also requires an intersectional approach that addresses the multiple and intersecting forms of discrimination that women particularly on marginalised groups of women (such as by race, ethnicity, religion, disability, migration status), face. Marginalised groups of women will face greater challenges in obtaining economic empowerment and are more likely to face obstacles when accessing resources, throughout the continuum of unpaid to paid work, and especially with regards to discrimination in paid labour markets.

WOMEN’S FINANCIAL INCLUSION

WFI is meaningful access to, use of, and control over financial services, which create economic and social benefits critical to realising economic rights, gender equality, and WEE.

For women, meaningful participation in the financial sector goes beyond formal [1] and informal [2] types of banking services for individual, household or business use. WFI accounts for the range of ways women’s economic and social lives may benefit from financial services, particularly when such services embed women’s unique needs. Financial services which contribute to WFI account for demand and supply side constraints that may limit women’s uptake and use of services whilst also considering how these services can transform women’s lives by breaking down gender norms, increasing financial capability and providing women with decision-making power and autonomy.

WOMEN’S EMPOWERMENT COLLECTIVES

WECs is a concept that describes groups of women who meet regularly to achieve a shared purpose. Around the world, women join groups or collectives to provide economic and social support for each other.

These groups take different forms, but they share common features, including voluntary membership, self-governance, contributions in the form of time, labour, or money, regular meetings, and the aim to empower and improve the welfare of their members.

Research from various countries has shown that these groups are powerful and cost-effective models to deliver critical health, livelihoods, empowerment, and financial inclusion benefits to women. Evidence also suggests that these groups have the potential to reach more women and achieve greater impact by expanding their programming or linking to services and markets. Access to WECs is particularly important for the most disadvantaged and marginalised women in any given context and particular attention should be given to establishing WECs to meet their unique needs in ways that are supportive, inclusive and ensure equal treatment.

Aligned with the Bill & Melinda Gates Foundation’s definition, WECs can be made up of some or all of the elements below which meaningfully support women’s empowerment including:

- Pooling savings and sharing risks: Opportunities for saving and lending; links to financial institutions; pooled risk and resources to build group equity

- Group solidarity and networks: Building individuals’ social networks; fostering trust and group cohesion

- Participatory learning and life skills: Practical and relevant learnings that members can learn by doing together and business-related collective problem–solving

- Critical consciousness of gender: Empowerment; dialogue and peer–to–peer sharing; collective problem solving; greater control, decision-making and negotiating power

- Access to markets and services: Reduce transaction costs and linkages to local government and service providers

GENDER INTEGRATION

Apart from tracking funding, we also assessed how donors prioritise Gender Integration (GI) through their organisational policy, programming, and within their WEE funding.

GI is the process of taking into consideration the impact of any planned actions, including legislation, policies or programmes on women, men and nonbinary persons. GI uses gender analysis in programme design, implementation and impact assessment to consider the different ways that people perceive and experience a situation or problem depending on their gender, and how best to address inequalities in gender outcomes. This strategy accounts for gender norms, roles, responsibilities and gender-based inequalities when assessing the implication of a product or service for women, men, and nonbinary persons. GI is most effective when it incorporates an intersectional approach, taking into account marginalised groups within gender populations that may be impacted, and designing policy from an intersectional perspective to avoid perpetuating inequality.

1 E.g., basic bank accounts, savings, loans, insurance.

2 E.g., Village Savings and Loan Associations (VSLAs), rotating Savings and Loan Associations (ROSCAs), microfinance associations.