Why do DFIs invest in financial intermediaries and why do we need to know more?

At the start of November 2021, Publish What You Fund’s Development Finance Institution (DFI) Transparency Initiative marked a new phase in our project with the launch of our DFI Transparency Tool and our report Advancing DFI Transparency. To accompany the launch, we are publishing a series of blogs that discuss the process of developing the tool and introduce its key components. In the first blog of the series, Paul James reflected on the two years of research that have informed the creation of the tool. We have since dived into the first four components of the tool: core information, impact management, environmental, social and governance (ESG) and accountability to communities and financial information. This blog discusses elements of the tool’s fifth component – financial intermediaries– and outlines the importance of transparency for financial intermediary investments in order to understand their impact and allow community accountability efforts.

Financial Intermediaries: What are they and why do DFIs invest in them?

The term financial intermediary (FI) covers a broad range of institutions and organisations that DFIs invest in with the purpose of enabling on-lending activities to take place. These can include both banking institutions and funds such as private equity funds, debt funds and venture capital funds, as well as non-banking institutions such as insurance companies and microfinance institutions. In recent years, these types of investments have become increasingly popular amongst DFIs and have taken on more complex forms. Whilst early investments were typically in the form of loans provided for project financing, current investments include novel finance forms such as bond participations and underwriting, corporate loans, and guarantees or insurance.

Research conducted by Oxfam in 2018 indicated that FI investments represented 55.4% of the International Finance Corporation’s (IFC) total investment portfolio and 52% of CDC’s portfolio, while also representing significant portions of portfolios of the European Investment Bank (EIB) (45%) and FMO (30%). Our own analysis of US International Development Finance Corporation’s (DFC) 2020 activity found that out of 84 projects (approximately $4.8bn), 45 ($3.1bn) can be classified as FI investments. As such, FI operations represented approximately 53.5% of total projects and 64.9% of total approved financing for DFC.

DFIs invest in FIs for a number of reasons. One principal benefit of FI financing is that it has the potential to increase both the breadth and depth of DFI activity. Ticket sizes for direct investments of DFIs are typically large, and therefore not suited for addressing important aspects of developing economies such as financing of the micro, small and medium enterprise (MSME) sectors. MSMEs play a crucial role in developing economies, where they represent a large portion of the country’s gross domestic product (GDP) and create the majority of new jobs.

Why are financial intermediary investments controversial? And why is transparency important?

Despite the important role that FIs play in the portfolios of most DFIs, they have also proven to be amongst their most controversial investments. Accountability groups have documented the harmful environmental and social consequences of FI investments and have raised concerns around FI investments in coal power stations and links to fossil fuel, predominance of tax havens as domiciles for private equity funds and questions of corruption.

Transparency plays an important role in navigating risks associated with DFI FI lending. Firstly, it is especially important for project-affected communities to know whether a DFI has indirectly financed a project that impacts them. Without this knowledge, communities will not be able to hold DFIs accountable and seek redress where harm is caused. Secondly, without adequate transparency, the developmental impact of FI investments in comparison to other forms of development finance, will be difficult to monitor. As such, it will be difficult to assess how beneficial FI investments actually are.

What do DFIs currently disclose?

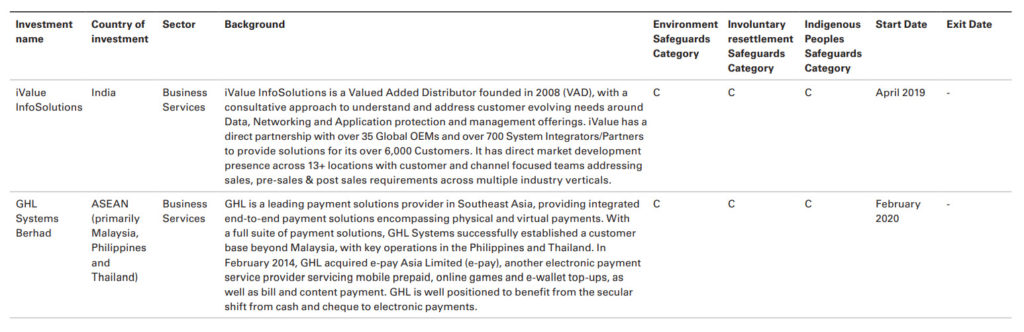

Our research found very few cases of disclosure of FI investments. One positive example included the Asian Development Bank’s (AsDB) investment in Creador IV, a private equity fund that focusses on South and Southeast Asia. As shown below, in this particular case AsDB disclosed a narrative description of the sub-investments (“Background”), safeguard categorisations, start dates and exit dates for each sub-investment. It is important to note however that this form of disclosure is part of a new practice and is not reflective of systematic practices for AsDB.

How will the DFI Transparency Tool approach FI investments?

Our DFI Transparency Tool provides granular guidance to DFIs about the types of information that a range of stakeholders value and that should therefore be disclosed, based on their obligations as publicly owned entities that manage and disburse public money. It also forms the basis of future and ongoing assessments of the transparency of DFIs.

In the DFI Transparency Tool, FI investments are seen to take place at two levels: at the FI level and at the FI sub-investment level. FI level disclosure is applicable to all types of FI investments including funds, banks, microfinance institutions and others. Our transparency tool highlights that DFIs should disclose the same information on FI investments at the FI level as they disclose for other direct investments. This is because FI investments are subject to the same types of decision-making processes, such as consideration of relevant ESG risks and development impact, as direct investments. Moreover, a significant amount of FI investment information is already available from other sources including publications by the financial institutions themselves, disclosure to other bodies such as regulatory institutions, and disclosure behind paywalls.

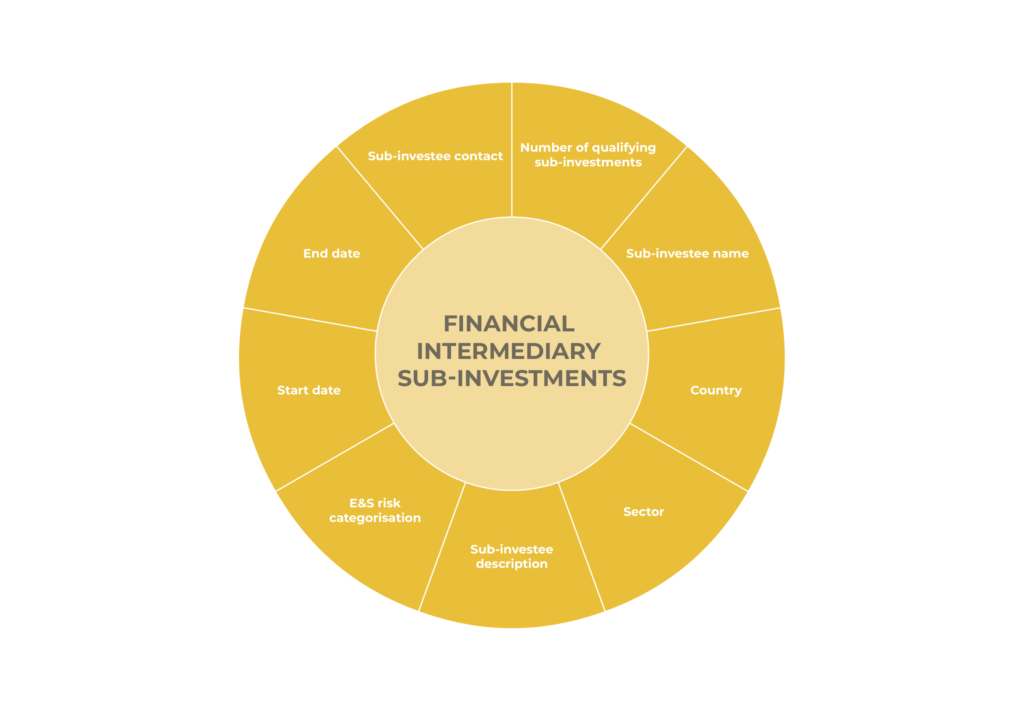

FI sub investments, which refers to the on-lending activities of financial intermediaries, are treated slightly differently in our transparency tool. Given that almost no information can be found of sub-investments, we adopted an approach that measured their progress towards transparency rather than a definitive measure of their current state of transparency. We identified nine indicators specifically for sub-investments (number of qualifying sub investments, sub-investee name, country, sector, sub-investee description, E&S risk category, start date, end date, and sub investee contact).

Our transparency tool has received the support of a number of stakeholders including the EBRD and US DFC at the launch event. To further encourage change within the sector we will be using the DFI Transparency Tool as the framework through which we will analyse the transparency of leading DFIs during 2022. Within the next month, we will be publishing a methodology for this analysis with a view to publishing an initial assessment and ranking in early 2023.

Further reading:

The illusory promise (and real potential) of new DFI impact management tools

Transparency of financial information: The key to increasing development flows