What is core information and why is it fundamental to the transparency of development finance institutions?

At the start of November 2021, Publish What You Fund’s DFI Transparency Initiative marked a new phase in our project with the launch of our DFI Transparency Tool and our report Advancing DFI Transparency. To accompany the launch, we are publishing a series of blogs that discuss the process of developing the tool and introduce its key components. In the first blog of the series I reflected on the two years of research that have informed the creation of the tool and highlight three key lessons: that development finance institutions (DFIs) are improving both in their operations and their transparency, that progress in these regards is uneven, and that there are widespread demands for improved transparency. This blog introduces the first of the components of our DFI Transparency Tool, core information. It also expands on the second of the above themes, uneven progress in improving transparency.

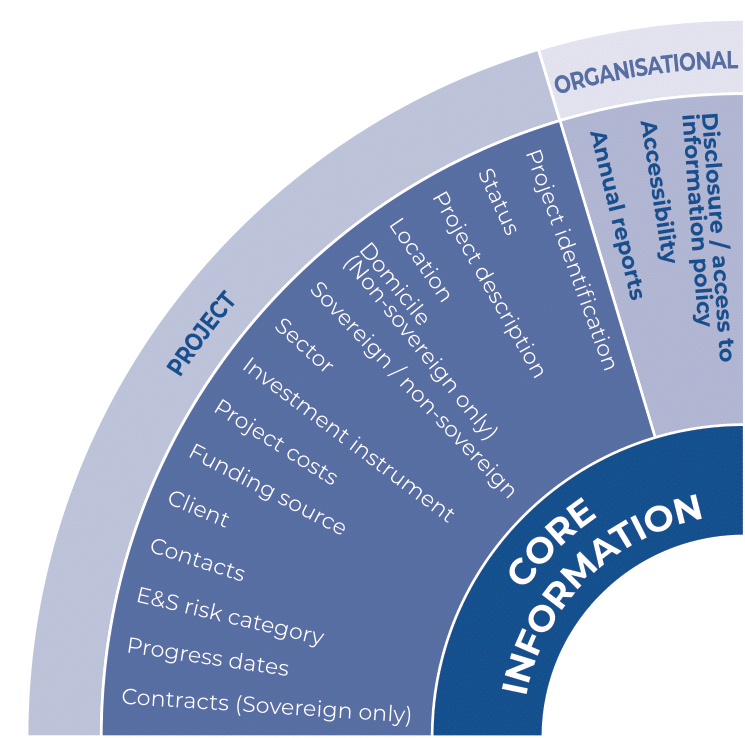

When designing the DFI Transparency Tool we had to decide what type of information should be considered core information and what information belonged in more thematic components such as financial or impact information. For example, project costs could quite legitimately be placed within financial information, yet we thought it was more helpful in core information. To inform these decisions we needed a working definition of what qualifies as core information. Recognising that core information covers both organisational policies and documents, and project level data, we devised two complimentary definitions:

- Organisational level indicators: The core policies and organisational documents that contribute to the transparency of a DFI. These are fundamental aspects of a DFI’s transparency that apply universally across their activities.

- Project level indicators: The first tier of information that a data user will encounter when they look up a project. The data is typically concise and may be quantitative or qualitative. It can be disclosed across a number of sources including, but not limited to, DFI websites, databases and annual reports.

On the face of it, the core information component is perhaps not the most ground-breaking, or complex, information that we are advocating to be disclosed. However, when viewed as the fundamental building blocks upon which the more complex data of the other components is built, the importance of DFIs achieving full disclosure across this component becomes clear. What use, for example, is the publication of environmental and social impact assessments if project affected people cannot first identify the name and location of DFI investments? However, as demonstrated in our first workstream report, while barriers to publication of core information are low, transparency remains both far from complete and uneven in its application across institutions.

Indicator 2 of our tool, ‘Accessibility’, will assess the accessibility of data that DFIs disclose through their data portals and databases, rewarding systems that allow free, bulk export of data, contain detailed disaggregated data, and in which data is published under an open licence. As in other areas, current accessibility of data is variable across DFIs. While some DFIs such as CDC and IFC allow the bulk export of data directly from their project databases, others such as FMO and DEG only make project data accessible on their websites. Another group of DFIs including AsDB and DFC follow a third path where they maintain a downloadable data file of active projects which is not directly linked to their website database. While this marks an improvement on the lack of any downloadable data, it carries risks in terms of the completeness of data. Currently, both institutions’ data files are either out of date or representative of only a portion of total activity.

Another area that our research identified variable practice in was the disclosure of the source of funds that DFIs use to finance their investments. Not all capital deployed by DFIs comes from the same balance sheet. Rather, DFIs deploy funds from a variety of sources including bilateral and multilateral trust funds and concessional window capital. This is significant as finance provided from these types of sources is often provided on very different terms to that provided from the DFI’s own resources. Therefore, identifying the source of funding represents an important building block in identifying more complex information such as levels of concessionality, which we will revisit in a later blog. Practice in disclosing the source of funds is divergent across DFIs. AsDB are arguably setting the benchmark in terms of this disclosure, identifying all individual sources of funding, including amounts provided. They also allow data users to search for and filter projects according to funding source. However, our research found that disclosure of the source of funding was low amongst bilateral DFIs, with only FMO routinely disclosing this information and CDC doing so but not in a systematic manner.

It is in this context that we have launched the DFI Transparency Tool. Our research has shown that disclosure of information in line with the tool is ambitious but achievable. Furthermore, stakeholders have identified the information defined by the tool as important, highlighting the need for DFIs to act now to improve their disclosure. The tool has received the support of a number of stakeholders including the EBRD and US DFC at the launch event. To further encourage change within the sector we will be using the DFI Transparency Tool as the framework through which we will analyse the transparency of leading DFIs during 2022. Over the next few months we will be consulting on a methodology for this analysis with a view to publishing an initial assessment and ranking in a year’s time.

Further reading:

The illusory promise (and real potential) of new DFI impact management tools

Transparency of financial information: The key to increasing development flows

Why do DFIs invest in financial intermediaries and why do we need to know more?